Levin Sources recently completed strategic assessments of transition minerals in 11 countries relevant to the just energy transition to support policymakers, philanthropic funders, industry and civil society – all of whom are part of the Levin Sources’ community - by identifying the major levers through which minerals supply can be made more secure and resilient. The reports offer guidance which we know will be useful for our community to prioritise where greater attention and investment are needed to propel the just energy transition through action on minerals value chains.

You can access the global findings report here and the country reports by contacting us directly at hello@levinsources.com.

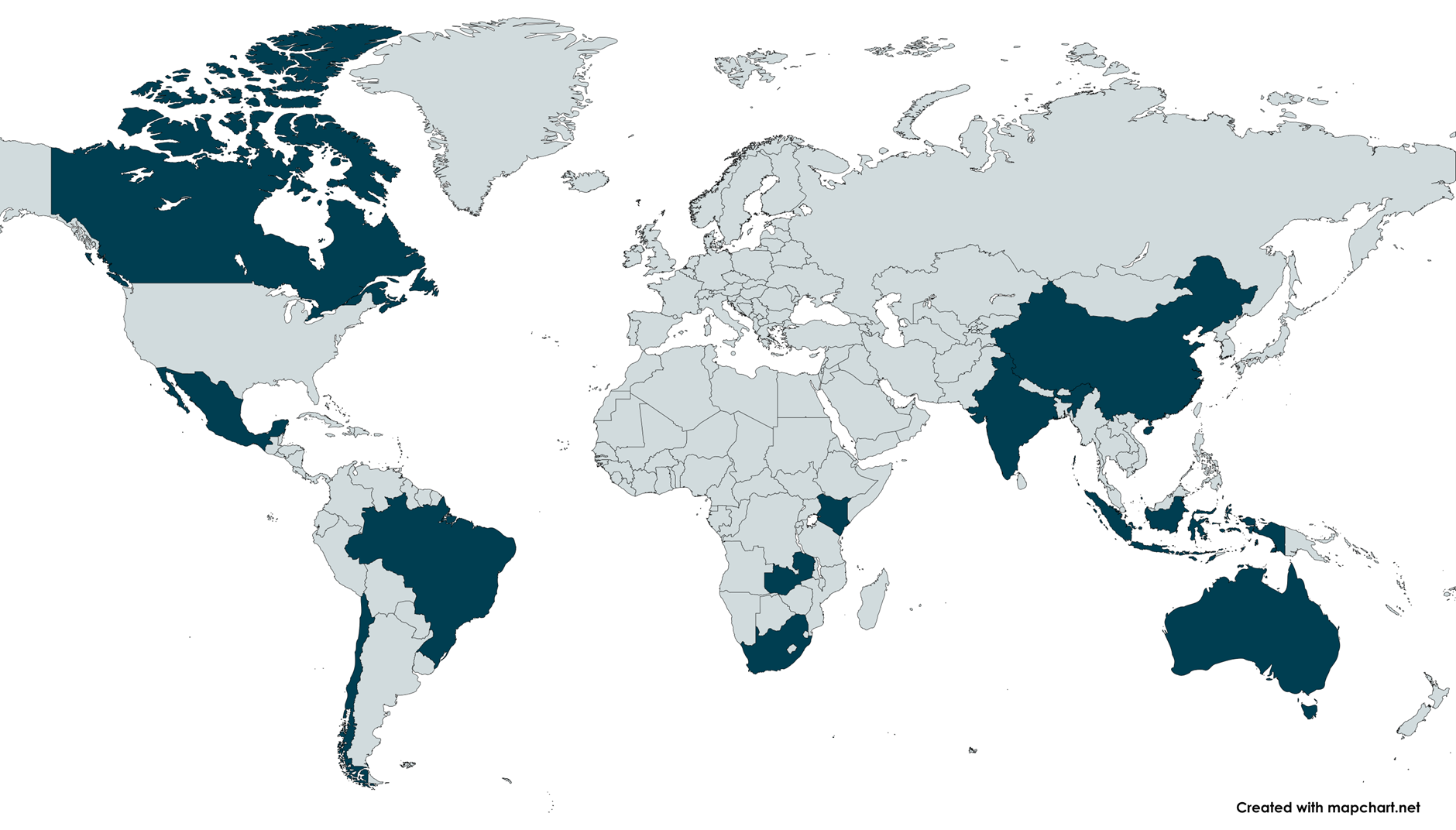

Levin Sources and our law firm partner dove deeply into Australia, Brazil, Canada, Chile, China, India, Indonesia, Kenya, Mexico, South Africa, and Zambia. We then analysed our findings to identify key entry points for global and national attention in four priority countries where action on energy transition minerals supply has global significance and strategically assessed which investment opportunities will drive greater scaling and sustainability.

The minerals in scope are cobalt, copper, graphite, lithium, manganese, nickel and phosphate, as well as other prevalent transition minerals of high materiality to the studied countries. These minerals were selected based on a global landscape assessment of the minerals needed for the energy transition, which was done by Dalberg Advisors in 2023 with our contributions. We also looked at recycling opportunities in certain countries, especially where an informal sector is already burgeoning.

In which transition mineral countries and on what issues should we be focusing resources to maximise climate mitigation?

Challenge:

The feasibility and speed of accessing transition minerals will influence how fast we are able to transition our energy systems.

- How can we ensure that constraints in the supply of transition minerals do not impede efforts to mitigate climate change?

- And, where there is momentum, how can we ensure that we are not trading off other issues of planetary significance (including peace, human rights, biodiversity)?

- How can private, public and philanthropic funding be directed towards maximising climate mitigation through action on transition minerals value chains in the selected countries?

How the reports recommend a solution:

Each report deeply delves into the country’s ambition, capacity, and potential to build a resilient, flexible and responsible supply of the raw materials and recycled metals that are crucial to the energy transition. They identify key entry points for stakeholders to best leverage existing momentum, infrastructure, and investments, such as driving greater value addition and circularity in host nations, advancing women’s rights and strengthening public reporting on environmental management, amongst many others. The reports propose ways to address each entry point in each country in detail.

Our research identified the opportunities and constraints presented by each jurisdiction’s ambition, mineral production potential, and policy and regulatory environment, as well as the extent of civic space and prominent environmental, human rights and governance issues. It also identified the existing and emergent mineral-issue-geographic complexes (hotspots) where action is most urgently needed, the initiatives that are taking action, and thus the opportunities to add value to existing efforts. Some of the hotspots identified include Queensland and the Northern and Western Territories in Australia; Manitoba, Ontario and Quebec provinces in Canada, and the northeastern part of South Africa, which host substantial transition minerals activity.

Strategic assessment of priority opportunities for investment

Challenge:

We gathered a large amount of useful information from the country study deep dives. But how to prioritise opportunities across those countries? What opportunities should be deemed more likely to be successful? Which actions can generate spillover effects or co-benefits to drive global change?

Providing a strategic analysis of the solutions:

Levin Sources carried out a comparative analysis of the 11 countries to prioritise the opportunities where attention and investment are needed. The analysis highlighted the key issues across countries that act as bottlenecks or could be opportunities to push transition mineral supply chains towards responsible practices. We identified the following levers where global investment and action should be prioritised in order to advance the sustainability and resilience of global supply chains for minerals that are essential to the energy transition:

1/ Economic levers

- Enhance recycling rates: Address barriers to recycling in scrap processing hubs in India, Kenya and Mexico, improving recovery rates and reducing global reliance on mining.

- Support regenerative mining: Convene stakeholders active in remining and phytomining to catalyze action that will overcome barriers and foster innovative, sustainable and commercially viable mining practices.

- Locational clustering and joint action: Promote the co-location of minerals development to increase commercial viability, the manageability of ESG risks, and enhance economic outcomes. Support cooperation between stakeholders in these clusters to tackle joint issues.

2/ Environmental levers

- Integrate process circularity along mineral value chains: Encourage and support mining and metallurgy to adopt circular economy principles while actively seeking equity and co-benefits in implementation (e.g. strengthen energy & water security for affected communities, generate economic opportunity for circular solutions, etc.).

- Strengthen environmental governance: Advocate to governments for stronger Environmental and Social Impact Assessments (ESIA), mandatory nature-related disclosures to protect ecosystems (e.g. TNFD), and the adoption of laws that afford rights to nature.

- Combat pollution and decarbonise: Tackle pollution in affected regions and support the decarbonization of energy sectors in key countries.

3/ Social levers

- Expand civic space: Protect human rights and environmental defenders, promote Free, Prior, and Informed Consent (FPIC) and equip Indigenous Peoples and local communities with the skills and resources necessary to achieve equitable distribution of benefits and harms.

- Empower women and workers: Invest in women's economic empowerment and safeguarding in mining companies and communities and strengthen unions to improve workers’ rights.

- Support artisanal and small-scale mining: Build a global understanding of ASM in critical minerals to bridge information gaps and provide meaningful support.

4/ Governance levers

- Promote transparency and anti-corruption: Focus anti-corruption efforts in the minerals sector and improve structures for monitoring and reporting associated benefits and harms

- Support access to remedy: Strengthen pathways for rights-holders to seek remedy for unremedied harms, ensuring accountability and justice

- Foster cooperation: Invest in consensus- and collaboration-building processes to overcome barriers to sustainably scaling critical mineral value chains

Besides these globally relevant themes, we also identified the top countries where success is most likely, where action will generate a global benefit and/or where there is an opening to leverage existing momentum, infrastructure, or ambition to secure resilient and flexible global supply chains for raw materials needed for the energy transition. These countries are Brazil, Chile, Indonesia and Zambia. All of the other countries hold enormous potential, too, particularly in scaling recycled metals.

Access to the reports

The country's deep dives and strategic assessments are available on a bilateral and confidential basis.

Leverage organisations’ strategy around transition minerals

These reports are a starting point for individual stakeholders who wish to build an investment or resource allocation strategy in transition minerals value chains (especially where it is a priority to drive growth and deliver sustainable development). We can provide strategic advice on specific actions to invest in mineral value chains aligned with a particular organisation’s values and needs.

If you are interested in receiving intelligence or support to guide your strategy around minerals investment, please reach out to us at hello@levinsources.com.

* This research was conducted thanks to funding from ClimateWorks Foundation (CWF), a global platform for philanthropy to innovate and scale high-impact climate solutions that benefit people and the planet ClimateWorks Foundation delivers global programs and services that equip philanthropy with the knowledge, networks, and solutions to drive climate progress for a more sustainable and equitable future. Since 2008, CWF has granted over US$1.7 billion to more than 750 grantees in over 50 countries.